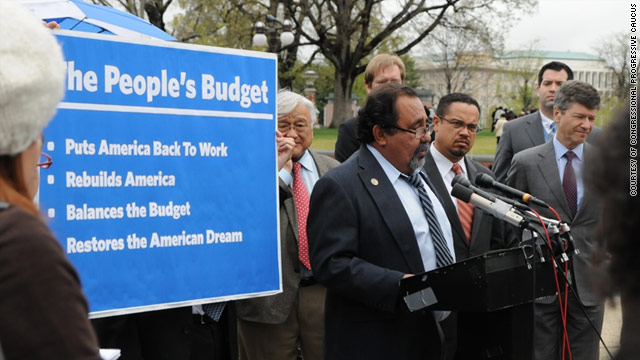

Photo: Progressive Caucus Members announcing their alternative

The People's Budget:

Quick Summary of a Good Plan

By Kay Kirkpatrick

Beaver County Blue

Among the budgets proposed in Congress recently, one eliminates the deficit in 10 years, puts Americans back to work, and restores our economic competitiveness.

Unlike the GOP proposal from Rep. Paul Ryan (R-WI), the People’ Budget does not seek to crush those with a low-income, the elderly or otherwise cripple vital government services.

Instead, it preserves Social Security, Medicare, Medicaid, and unemployment benefits; expands jobs and job training programs; shifts the tax burden off the backs of the people; eliminates tax credits for the oil and gas industries and subsidies for new nuclear power plants; invests in infrastructure and brings our troops home.

This version of our financial future, proposed by the Congressional Progressive Caucus (CPC), is not only in keeping with priorities of the majority of the American people, it is viable, reasonable and sustainable.

The CPC plan ends the budget deficit two decades earlier than the Ryan plan. Specifically, the budget offers:

· $5.6 trillion in deficit reduction

· $869 billion in spending cuts

· $856 billion net interest savings

· $3.9 trillion revenue increase

· $1.7 trillion in public investment, and

· $30.7 billion in a budget surplus in 2021.

The CPC would end corporate welfare for oil, gas and coal companies, refine taxes on the overseas monies made by U.S. corporations, and create a financial speculation tax.

Furthermore, the CPC lets the Bush-era tax cuts to expire at the end of 2012 and implements additional taxes for millionaires, tax capital gains and qualified dividends as ordinary income and establish a progressive estate tax. The Caucus also winds down funding for overseas wars and reduces military spending.

Instead, the U.S. will invest in the people's future, providing $1.45 trillion in job creation, education, clean energy, broadband infrastructure, housing, and research and development. We will put $213 billion to work fixing roads and bridges. Additionally, the CPC wants to create a new Infrastructure Bank (IBank) to provide loans and grants to for individual of significance to our nation's economic competitiveness. The IBank could support revitalization just as Community Develop Grants have been used to turn rusted out steel mills into new development. The IBank could take on larger challenges like upgrading our road, rail and even air travel and transport.

The CPC also allows citizens with no adequate health insurance to be able to collectivize--just like they were getting a discount through a group plan at work--known as the public option. They would negotiate prescription payments with drug companies.

The CPC budget is focused on our common future clearly embraces our need for tomorrow's citizens to have a good education and a skilled workforce that is ready for the technological era; for our nation to rebuild its highways and waterways, not only for our personal use, but also to be able to transport and sell goods on a global scale; to overcome our dependence on foreign oil by unleashing the emerging clean energy industry that can make us a leader in the fight against global warming; and to support efforts to keep Americans working and housed, not jobless and foreclosed.

Clearly, the Caucus will scale back the out-of-control military spending that has skyrocketed in the last decade and contributed significantly to the deficit. Another primary component is to refund the government by returning to Clinton-era tax rates. But, the program will also maintain education incentives, credits, and incentives to help families. Additionally, millionaires will pay more--a progressive set of tax brackets starting at 45% for married couples taking in more than a million dollars a year and increasing to 49% for people making more than a billion dollars a year.

U.S. corporations that have overseas subsidiaries will be expected to pay taxes on their earnings as they go, not hold their profits off shore indefinitely. A U.S. company that takes jobs overseas could not benefit from this beyond-the-border loophole. Nor will fossil fuel companies be allowed to receive corporate welfare from the government. In fact, CPC will reinstate the Environmental Protection Agency's Superfund program which is used to clean up hazardous chemical spills and dangerous sites. While companies are supposed to clean up their own messes, the Superfund (financed by an excise tax on such companies) is available when a company goes bankrupt or missing, say, in the event of a Marcellus Shale fracking incident.

Large banks with over $50 billion in assets will get a new tax. Wall Street will get a gaming tax aimed at financial manipulators. The CPC also expects to promote going after corporations that notoriously dodge taxes.

With the CPC budget, we will have a surplus of $30 billion in 10 years. But, we will also have invested in renewable energy; in conserving wetlands and natural resources; in revitalizing regions and communities that face brownfields, jobless or decline; in helping the international community fight disease and hunger; in creating green jobs; in improving health for our citizens; in keeping housing affordable and keeping houses heated in the winter; in better benefits for military families and veterans; and in effective law enforcement.

In short, the CPC takes a square look at the deficit problem and solves it without demanding that workers give up collective bargaining; without claiming public education has got togo; and without ruining Medicaid and Social Security. It creates jobs and invests in a future that would make most citizens proud.

![[PDA - Heathcare NOT Warfare - Sign the Petition.]](http://pdamerica.org/images/ads/HealthNotWar_final.jpg)

No comments:

Post a Comment