A tiny fee charged to the biggest banks could generate hundreds of billions of dollars every year for social services, but what effect would it have on Wall Street?

By Kyle Chayka

Progressive America Rising via Pacific Standard

In a video released last month by an organization called The Robin Hood Tax, an increasingly frantic U.K. prime Mmnister (played by British actor Bill Nighy) is forced to defend his decision made 10 years ago back in 2014 not to pass a tax on banking transactions. While Nighy hems and haws, a trio of polished European Union leaders extoll the tax. They say that the revenue, drawn largely from investment bankers, has “restored health services” and “helped fight extreme poverty” in the wake of the global financial crisis.

The video, which has over 250,000 views, is clearly satire, but it comes at the forefront of a burgeoning political movement to do a little more to curtail the excesses that caused the 2008 crisis. The Robin Hood Tax also hosts an international petition with over 650,000 signatures that proposes levying a tax every time a bank trades in commodities like stocks, bonds, foreign currency, or derivatives. The fee would be small—just 0.03 or 0.05 percent of each transaction—but enough to raise $416 billion globally, the organization suggests.

That money would go toward solving basic social issues like public education, affordable housing, and public services—in other words, taking from the rich, as epitomized in the kind of hedge-fund gamblers depicted in Wolf of Wall Street, and giving to the poor, just like the initiative’s namesake.

By trading in risky commodities, the banks lost everyone a lot of money, so why not punish them for it by targeting the very transactions that caused the problem in the first place?

A Robin Hood-style tax, also known as a financial transaction tax, is on track to be finalized by a coalition of 11 European Union governments before May of this year, including Germany and France, where the tax has 82 and 72 percent approval respectively. German Chancellor Angela Merkel is pushing for progress on the tax before the May 2014 E.U. parliamentary elections; European lawmakers are actively pushing their United States counterparts to join the effort.

The idea of a financial transaction tax has a certain visceral appeal that the Robin Hood rhetoric reinforces: By trading in risky commodities, the banks lost everyone a lot of money, so why not punish them for it by targeting the very transactions that caused the problem in the first place? Yet it’s important to weigh the impact the proposed tax would have on Wall Street and Main Street alike.

One benefit of the tax is that it’s designed to make large banks bear the burden (as opposed to consumers or small business owners). Spot currency transactions—tourists switching from U.S. Dollars to Euros, for example—won’t be counted under the tax, nor will transactions with governmental banks, trades in physical commodities, and transactions involving private households, explains a briefing on the bill.

Yet critics fear that any restriction on the flow of investment capital could damage the economy for everyone, not just redistribute some of the wealth away from banks and bankers.

A report from London Economics points out that many households have savings invested in financial instruments that would be impacted by the tax. “In Italy, there is a high level of direct investment in financial markets, with 40 percent of household savings being held directly in the form of equity or debt,” the report notes, with 23 percent of household savings in Spain. The financial transaction tax would quickly make these investments less valuable by slowing down trading and, theoretically, growth.

Another fear is that taxing trading transactions in the European Union, or in the U.S. or U.K. where such a law is less imminent, will cause capital flight from the region as investors look to funnel their money through countries that don’t tax. A recent report by the U.S.-based Financial Economists Roundtable argues that the tax wouldn’t make as much money as has been suggested, since it would provide a disincentive for future business. “Volumes—and thus tax revenues—would shrink as trading dropped or moved to other locations or to lower-taxed vehicles,” the report reads. “A transaction tax imposed at any economically meaningful rate by only some countries would cause many transactions to be shifted to other countries.” What’s currently happening with corporate profits being shuttled through Ireland and the Caribbean, losing billions of dollars in tax revenue, could also occur with investment capital.

The Financial Economists Roundtable report cautions against a kind of cascade, where taxes on transactions would lower financial liquidity, meaning “less capital per worker in the long run and thus lower wages throughout the economy.” Though likely over-exaggerated in the report, the threat of capital flight, which would lead to more difficulty securing loans and start-up funding, is real. But there’s another way to structure a financial transactions tax so it’s even more tightly focused.

IN SEPTEMBER 2013, ITALY became the first country to pass a tax on high-frequency trading, the technology that hedge funds often use to buy and sell financial commodities in fractions of seconds. The tax is tiny at 0.02 percent, and it’s only levied on trades occurring every 0.5 seconds or faster (the Robin Hood tax plan includes a high-frequency tax along with wider-reaching measures).

The high-frequency trading tax is meant as a way for banks to pay for the damage they’ve caused to the economy, but it’s also meant to make trading more efficient rather than less. Driven by computational algorithms rather than human beings, high-frequency trading is less about allocating capital to the businesses that can use it best and more about gaining a competitive edge over other funds. The algorithms that control trading likely aren’t even completing trades, as Felix Salmon points out—they’re putting out buy or sell orders then rescinding them immediately in order to confuse the other algorithms they’re competing against. They might as well be called “high-frequency spambots,” Salmon writes.

Democratic Senator Tom Harkin and Representative Peter DeFazio have repeatedly introduced a U.S. high-frequency trading tax, most recently around a year ago. They propose a 0.03 percent tax on trades that excludes initial public offerings and bonds in order to dampen the tax’s impact on capital raising, which they say will amount to $352 billion in revenue over 10 years. The bill has repeatedly failed, and no plans have been announced to bring it back (Harkin declined to comment for this article).

We’ve already come to the point that stock exchanges are building laser networks to shave extra microseconds off their high-frequency trading. Though our country might benefit from seeing how the European Union’s full financial transaction tax plays out, perhaps it’s time for a little bit of Robin Hood to curtail the worst of the excesses that aren’t benefiting anyone but the banks.

Kyle Chayka is a freelance technology and culture writer living in Brooklyn. Follow him on Twitter @chaykak.

Read More...

Summary only...

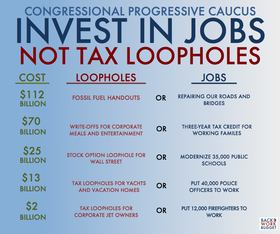

Presented by CPC co-chairs Reps. Raúl M. Grijalva and Keith Ellison and backed by members of the caucus' Budget Task force—Reps. Jim McDermott, Jan Schakowsky, Barbara Lee and Mark Pocan—the plan describes how smart investments, not deep cuts to key programs, would create almost 7 million jobs over the first year of its implementation.

Presented by CPC co-chairs Reps. Raúl M. Grijalva and Keith Ellison and backed by members of the caucus' Budget Task force—Reps. Jim McDermott, Jan Schakowsky, Barbara Lee and Mark Pocan—the plan describes how smart investments, not deep cuts to key programs, would create almost 7 million jobs over the first year of its implementation.

![[PDA - Heathcare NOT Warfare - Sign the Petition.]](http://pdamerica.org/images/ads/HealthNotWar_final.jpg)